If you’re thinking of selling your home, you might be wondering: how long does a house appraisal last? The short answer—usually 90 days. But if the deal takes too long or market conditions shift, that number can shrink fast.

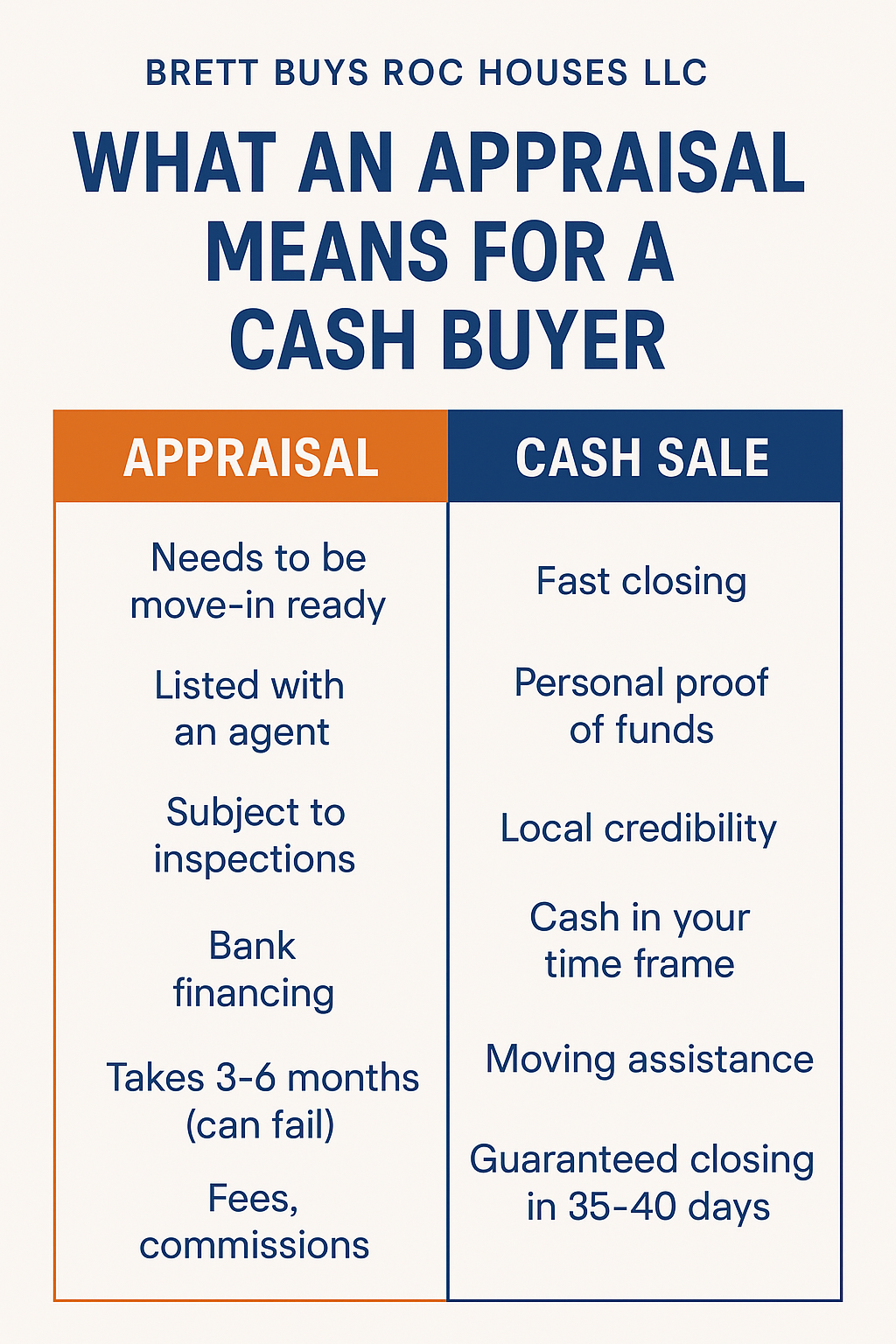

This is why more homeowners are rethinking the traditional process. Appraisals may be required for mortgage-backed buyers, but cash buyers often skip them altogether—saving you time, money, and uncertainty. Let’s break down the appraisal timeline, what it really means, and why some sellers are choosing to avoid it entirely.

How Long Does a House Appraisal Last?

In most real estate transactions, a home appraisal is valid for 90 days. However, this can vary depending on the lender’s requirements and the type of loan being used. Some lenders may require a fresh appraisal in as little as 30–60 days, especially in volatile markets.

Here’s a breakdown:

- Conventional loans: Typically valid for 90 days

- FHA loans: Good for 120 days (can be extended)

- VA loans: Often valid for up to 180 days

Important: If the appraisal expires before the sale closes, the lender may require a new one—costing you both time and money.

What is a Home Appraisal—And Who Really Needs It?

A home appraisal is a formal estimate of a property’s value. It’s conducted by a licensed professional who considers comparable sales, your home’s condition, upgrades, location, and other market trends. Appraisals are a must when a buyer is using bank financing, because lenders won’t loan more than what they believe the home is worth.

Here’s the catch: appraisals assume the home is in great shape and move-in ready. If your house has some wear and tear, needs updates, or is just a little outdated, that could drag the number down. And if the appraisal comes in lower than the offer? The deal might fall apart or require renegotiation.

How Cash Buyers Work—It’s Not Just About the Price

Cash buyers skip the entire financing headache. No banks. No waiting. No worrying about whether a lender will approve the deal.

Here’s what a good local cash buyer brings to the table:

- Fast Closings: Many deals close in under two weeks. No appraisals, no loan delays.

- Proof of Funds: You see their ability to pay right away.

- No Inspections or Contingencies: You won’t be asked to fix the roof, repaint, or replace anything.

- Local Credibility: Real people, not faceless corporations. Often, they live nearby and have a great track record.

- Your Timeline: Need to close in 10 days? Or 60? Totally up to you.

- Moving Assistance: Some cash buyers even help with moving costs or storage.

- All Fees Covered: That’s right—they may pay your closing costs, title fees, and skip the commissions.

When you work with the right buyer, you’re choosing convenience, speed, and peace of mind.

Cash Offer vs. Appraisal-Based Sale: Which Is Faster?

Let’s line up both options side by side so it’s crystal clear:

| Traditional Sale with Appraisal | Cash Offer |

|

|

The traditional route might work great if you have time, a picture-perfect house, and no pressure. But for many sellers, the cash option feels like hitting the “easy button.”

Why an Appraisal Doesn’t Reflect a Cash Buyer’s Real Value

An appraisal offers a snapshot of your home’s value on paper. But it doesn’t account for real-life value—your stress level, your timeline, your need for flexibility.

Cash buyers are problem-solvers. They aren’t waiting for perfect homes. They’re ready to buy as-is, make the process seamless, and help you move on.

Yes, you might accept a slightly lower price than what the open market could bring. But ask yourself:

- Will it cost you more in repairs, fees, and time?

- How much is peace of mind worth?

- Are you okay waiting months and hoping everything goes smoothly?

If the answer is no, a fair cash offer might actually net you more—not in price, but in freedom.

Real Seller Scenarios: When a Cash Buyer is the Better Choice

- Relocating Quickly: Got a new job or need to move fast? A cash buyer can close before the moving truck arrives.

- Inherited a Property: Don’t want the hassle of fixing up an inherited home? Sell it as-is.

- Facing Foreclosure: A fast cash sale might save your credit.

- Rental Property Woes: Tired of dealing with tenants? Cash buyers often take properties with renters in place.

Life Happens: Divorce, illness, or sudden life changes. Cash buyers move at your speed, not the bank’s.

Final Thoughts: Peace of Mind Has a Price Tag—And It’s Worth It

When you sell your home, you’re not just selling a building. You’re navigating emotions, logistics, and major life changes. Appraisals have their place in the traditional system, but they don’t speak to your unique needs.

A cash buyer sees the whole picture—not just the square footage or comps. They see your need to move forward without the noise. Without delays. Without strings.

So yes, the price might be a little less. But the value? It might just be exactly what you need.Looking to press the easy button? A trusted local cash buyer could be your best move—no appraisals required.

Frequently Asked Questions

What does a home appraisal mean for a cash buyer?

Most cash buyers don’t require an appraisal since they’re not using bank financing. They focus on the property’s potential and ease of transaction.

Why don’t cash buyers need an appraisal?

Because they’re not borrowing money, so there’s no lender involved to require one. It speeds up the process.

How long is an appraisal good for?

Generally, 90 days. After that, it may expire and require a new one if the sale hasn’t closed.

Is a cash offer better than market value?

It might be slightly less than full market value but can save thousands in repairs, fees, and delays.

What are the benefits of selling to a cash buyer?

Fast closings, no repairs, no commissions, flexible timelines, and less stress.

Do I need an inspection if I sell for cash?

Most cash buyers skip formal inspections or keep them minimal, buying the home “as-is.”